|

|

|

Mulvane Cooperative

Cash Bids

Market Data

News

Ag Commentary

Weather

Resources

|

Analysts Are Pounding the Table on This ‘Pioneer’ Nuclear Energy Stock

Oklo (OKLO) is a nuclear energy company that focuses on developing advanced fission power plants to supply clean and reliable energy at scale. Founded in 2013, it has its headquarters in Santa Clara, California. Oklo has a market cap of $7.34 billion and has had a fruitful year so far. The stock has climbed 147% in the year to date and more than 99% in the last month. Oklo is up 420% in a 52-week timeframe and trades just 11% below its 52-week high set in early February.

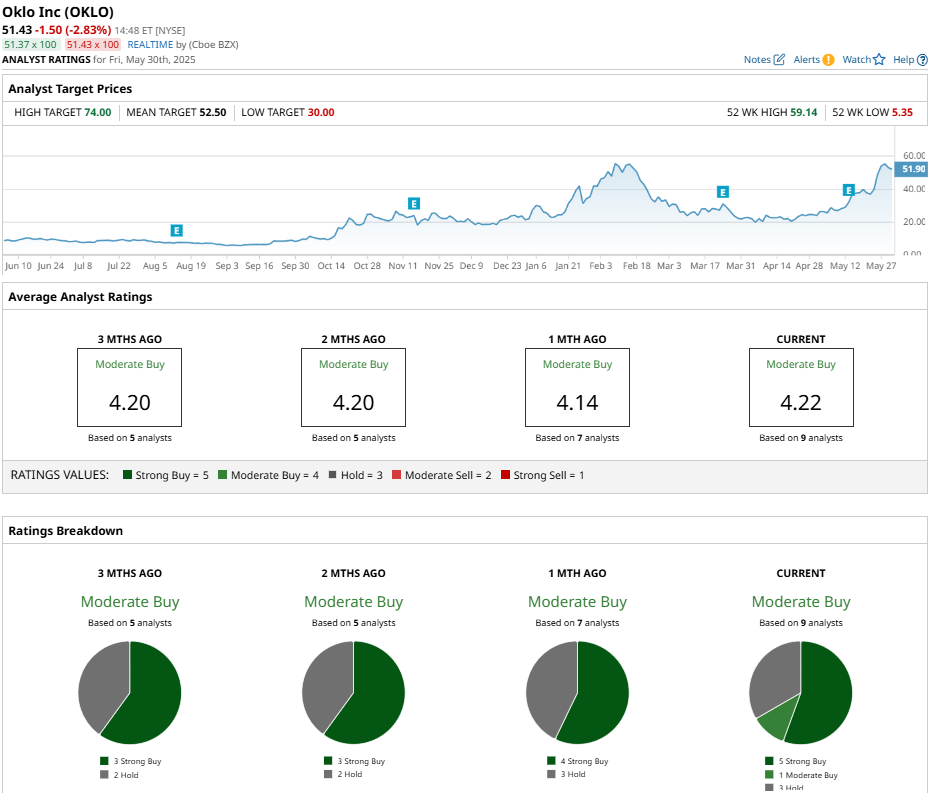

Oklo Reports Narrowing Adjusted Losses in Q1Oklo reported its first-quarter results on May 13, posting a loss of $0.07 per adjusted share, a huge improvement from the $4.79-per-share loss reported in the same quarter last year. The figure also outperformed analysts’ $0.10 per share loss estimates. The company did not generate any revenue during the quarter. In Q1 2025, the company’s operational losses took a significant hit, rising from $7.37 million to $17.87 million. The figure includes expenses such as research and development costs, which grew from $3.66 million to $7.85 million, and general and administrative expenses, which rose from $3.71 million to $10.03 million. Oklo used $12.2 million in cash for operating activities and ended the quarter with a solid cash reserve of $260.7 million as of March 31, 2025. Management anticipates using $65 million to $80 million in total cash for operations during 2025. They also reported that the company’s first small modular reactor (SMR) should be available by late 2027 or early 2028. Fresh Rating for OKLOOklo has received a fresh rating from William Blair, which initiated coverage of three nuclear stocks: BWX Technologies (BWXT), Centrus Energy (LEU), and Oklo. All three companies received an “Outperform” rating from the firm while Oklo has received a price target of $70, reflecting an upside potential of 35% from market level. William Blair pointed to the strong favorable background, technological advancements, and solid market positioning that each company has as key factors for the “Outperform” ratings. In its base-case scenario, analysts expect 7.5 GW of installed capacity by 2040 for Oklo. The analyst set a price target of $70 on shares, impyling nearly 35% upside potential from here. Oklo Receives Major BoostIn late May, President Donald Trump signed a number of orders to boost nuclear energy production. This includes an overhaul of the independent Nuclear Regulatory Commission (NRC), access to federal land for uranium (UXU25) production and enrichment, and shorter approval time for reactors. This has the potential to give Oklo’s upcoming small modular reactors (SMRs) a big boost, as they require much less uranium and space to function. Oklo expects to submit its former combined license application to the NRC by the end of the year and deploy its first SMR plant at Idaho National Laboratory by the end of 2027. Analyst Takes on OKLO StockAnalysts have mixed takes on Oklo with a consensus “Moderate Buy” rating. However, their mean price target of $52.50 hardly leaves any room for upside. The rating is based on nine analysts with five “Strong Buy” ratings, one “Moderate Buy” rating, and three “Hold” ratings.

On the date of publication, Ruchi Gupta did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here. |

|

|