|

|

|

Mulvane Cooperative

Cash Bids

Market Data

News

Ag Commentary

Weather

Resources

|

How Is Elevance Health's Stock Performance Compared to Other Healthcare Services Stock?/Elevance%20Health%20Inc%20billboard-by%20monticello%20via%20Shutterstock.jpg)

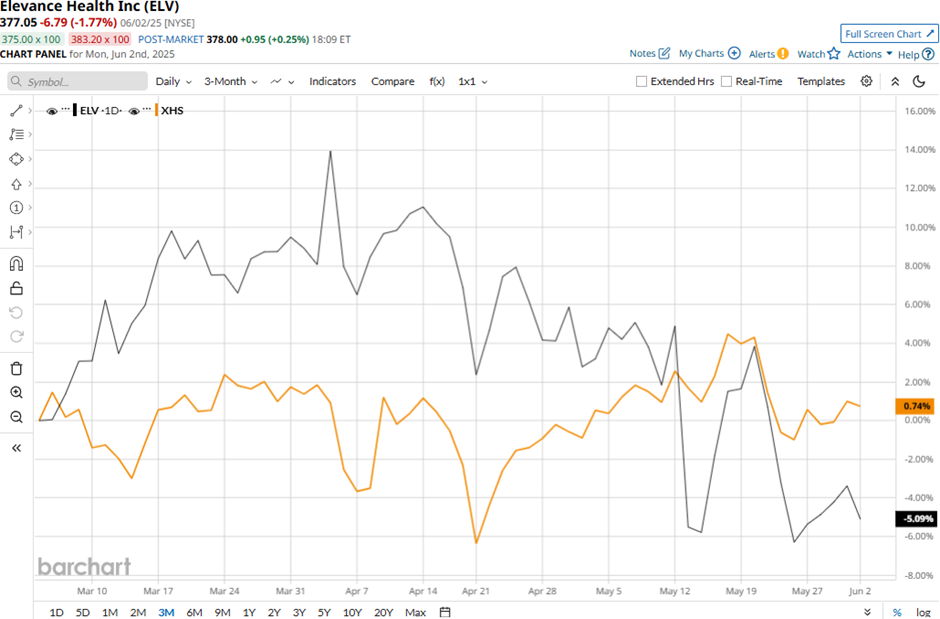

Indianapolis-based Elevance Health, Inc. (ELV) operates as a health benefits company. It supports consumers, families and communities across the entire healthcare journey, supporting them to lead healthier lives. With a market cap of $86.7 billion, Elevance operates through Health Benefits, CarelonRx, Carelon Services, and Corporate & Other segments. Companies worth $10 billion or more are generally described as "large-cap stocks." Elevance fits this bill perfectly. Given that the company employs over 100,000 associates and serves millions of people at every stage of health, its valuation above this mark is not surprising. It addresses a full range of needs with an integrated approach, powered by industry-leading capabilities and a digital platform for health. Despite its notable strengths, ELV stock has tanked 33.5% from its all-time high of $567.26 touched on Sep. 3, 2024. ELV stock has declined 5% over the past three months, underperforming the SPDR S&P Health Care Services ETF’s (XHS) marginal 52 bps dip during the same time frame.

Elevance’s performance has remained grim over the longer term as well. ELV stock gained 2.2% on a YTD basis and plunged almost 30% over the past 52 weeks, significantly underperforming XHS’ 7.7% surge in 2025 and 5.6% returns over the past year. To confirm the bearish trend, ELV stock has traded consistently below its 200-day moving average since the start of October 2024 and below its 50-day moving average since the start of the previous month.

Elevance Health’s stock prices rose 2.3% after the release of its impressive Q1 results on Apr. 22. Driven by higher premium collections, growth in CarelonRx product revenues and contributions from acquisitions, the company’s operating revenues for the quarter surged 14.8% year-over-year to $48.9 billion, beating the Street’s expectations by almost 6%. Meanwhile, the company adjusted net income for the quarter increased 7.2% year-over-year to $2.7 billion, exceeding analysts’ projections and boosting investor confidence. Elevance has also lagged behind its peer, The Cigna Group’s (CI) 14.1% surge on a YTD basis and 8.6% drop over the past 52 weeks. Nevertheless, analysts remain strongly optimistic about the stock’s long-term prospects. Among the 20 analysts covering the ELV stock, the consensus rating is a “Strong Buy.” Its mean price target of $495.83 suggests a 31.5% upside potential from current price levels. On the date of publication, Aditya Sarawgi did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here. |

|

|