|

|

|

Mulvane Cooperative

Cash Bids

Market Data

News

Ag Commentary

Weather

Resources

|

Do Wall Street Analysts Like Bio-Techne Stock?/Bio-Techne%20Corp%20site%20magnified%20-by%20Pavel%20Kapysh%20via%20Shutterstock.jpg)

Minneapolis, Minnesota-based Bio-Techne Corporation (TECH) develops, manufactures, and sells life science reagents, instruments, and services for the research, diagnostics, and bioprocessing markets. With a market cap of $7.7 billion, Bio-Techne operates through the Protein Sciences and Diagnostics and Genomics segments. Shares of TECH have significantly lagged behind the broader market over the past 52 weeks. TECH stock has dropped 40.7% over this period, while the broader S&P 500 Index ($SPX) has gained 12.5%. Moreover, shares of TECH are down 31.8% on a YTD basis, compared to SPX’s 1.3% return. Zooming in further, Bio-Techne has also underperformed the iShares Biotechnology ETF’s (IBB) 11.8% dip over the past year and 8.4% decline in 2025.

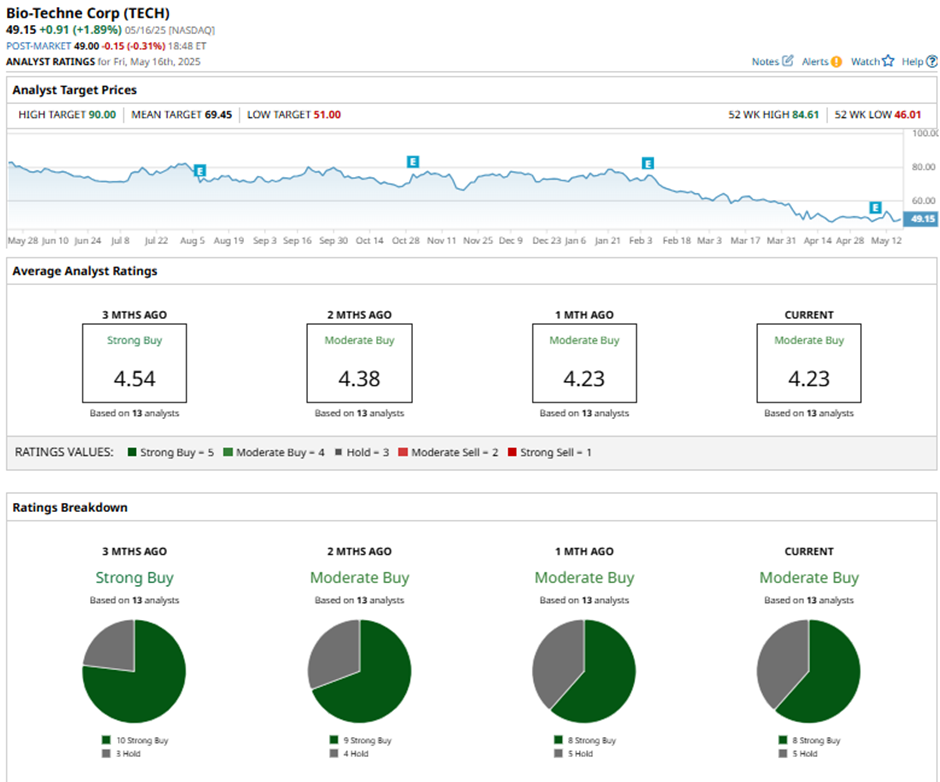

Bio-Techne’s stock prices rose 2.2% following the release of its better-than-expected Q3 results on May 7. The company reported net sales of $316.2 million, up 4.2% year over year, driven by continued improvement in the pharma end market, especially from large pharmaceutical partners. This contributed to solid performance in the cell therapy and protein analysis instrumentation businesses. Revenue from the Protein Sciences segment rose 6.1% year over year to $227.7 million. Adjusted EPS came in at $0.56, marking a 16.7% increase from the prior-year quarter and surpassing the consensus estimate of $0.51. For the current fiscal year, ending in June 2025, analysts expect TECH's adjusted EPS to increase 5.7% year-over-year to $1.66. The company's earnings surprise history is strong. It beat the consensus estimates in each of the past four quarters. Among the 13 analysts covering the TECH stock, the consensus rating is a “Moderate Buy.” That’s based on eight “Strong Buy” ratings and five “Holds.”

This configuration is notably less bullish than three months ago, with 10 “Strong Buy” ratings on the stock. On May 9, UBS (UBS) analyst Dan Leonard lowered TECH’s price target to $70 while maintaining a “Buy” rating on the stock. As of writing, Bio-Techne’s mean price target of $69.45 implies a 41.3% premium to current price levels, while the Street-high target of $90 suggests a staggering 83.1% upside potential. On the date of publication, Aditya Sarawgi did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here. |

|

|