|

|

|

Mulvane Cooperative

Cash Bids

Market Data

News

Ag Commentary

Weather

Resources

|

Is Peloton Stock Headed to $10 in 2025?

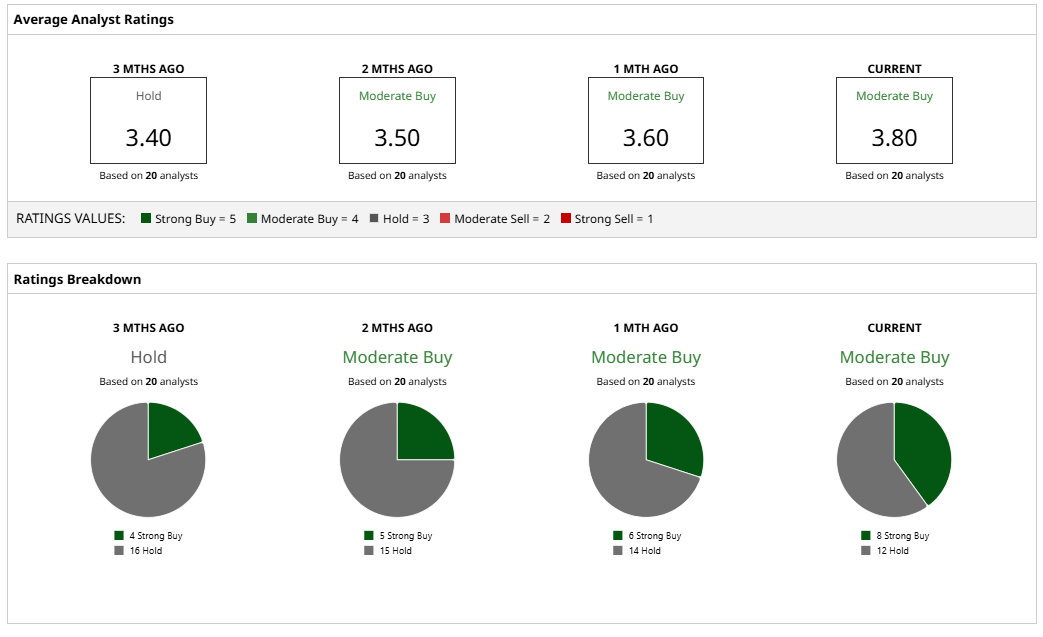

While Peloton stock (PTON) has rebounded sharply from its April lows, at which it briefly joined the penny stock category, it is still down nearly 26% for the year. The company posted mixed earnings for its fiscal Q3 2025 earlier this month, and the stock plunged following the confessional.  While brokerages including Goldman Sachs and Telsey Advisory cut Peloton’s target price following the Q3 earnings, Macquarie has upgraded the stock to an “Outperform” while assigning a target price of $10. The firm’s target price is slightly higher than Peloton’s mean target price of $9.72 and represents upside potential of over 50%. PTON Stock ForecastWall Street analysts have gradually turned bullish on Peloton stock this year. Eight analysts now rate it a “Strong Buy,” while the corresponding number three months back was just four. The remaining 12 analysts rate PTON as a “Hold” or some equivalent. Along with analysts, some fund managers have also warmed up to Peloton. For instance, legendary investor David Einhorn of Greenlight Capital finds Peloton stock undervalued and has put money where his mouth is. His fund is now among Peloton’s top 10 investors, owning a 2.8% stake in the fitness equipment company. Peloton is a pandemic-era darling whose sales and, by extension, share price, soared between 2020 and 2021. At its peak, Peloton’s market cap was over $50 billion. Cut to 2025, and its market cap is under $3 billion, and the stock has been moving in and out of the penny stock category.  Peloton Is Working on a TurnaroundPeloton has been working on a turnaround for the last couple of years. In February 2022, Barry McCarthy – the former Netflix (NFLX) and Spotify (SPOT) executive – took over as CEO, replacing the company’s co-founder, John Foley. Under his leadership, Peloton took several actions like doubling down on third-party sellers, giving up manufacturing ambitions, and selling bikes on rent. As is the case with practically every turnaround, Peloton slashed its workforce and cut down on its operating expenses. These strategies helped the company pare its losses and turn free cash flow positive. Earlier this year, Apple Fitness+ (AAPL) co-founder Peter Stern took over the baton from McCarthy and is now leading the next leg of Peloton’s turnaround. He is focusing on growth, and during the recent earnings call listed four key priorities. These are:

Should You Buy Peloton Stock?Peloton is a much different business now than it was during the pandemic, and two-thirds of its revenues come from the high-margin subscription business. However, on the flip side, its product revenues have been sliding, and member growth has sagged. The company’s revenues fell in the last three fiscal years, and consensus estimates call for a year-over-year decline in the current as well as the next fiscal year.  Meanwhile, thanks to Peloton’s aggressive cost-cutting actions, it has posted positive free cash flow and adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) for five consecutive quarters. The company expects its free cash flow in the current fiscal year to be around $250 million, which implies a price-free cash flow multiple of under 11x. The multiples look reasonable if not outright tempting given Peloton’s anemic growth (or rather degrowth). Overall, I believe the risk-reward looks balanced for Peloton at these levels, especially for investors who can stomach the near-term volatility. The company’s turnaround is on the right track, and as it turns the corner on its top-line growth while maintaining the strong free cash flows, the stock should head into double digits. On the date of publication, Mohit Oberoi had a position in: AAPL , PTON , NFLX . All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here. |

|

|