|

|

|

Mulvane Cooperative

Cash Bids

Market Data

News

Ag Commentary

Weather

Resources

|

MicroStrategy Stock Just Hit a New YTD High. Is MSTR a Buy in May 2025?

Cryptocurrencies are stealing the spotlight once again this year. A sharp price surge has been driven by improving market sentiment after President Donald Trump unveiled a trade deal with the United Kingdom and reached a 90-day tariff pause with China. These moves eased some of the uncertainty that’s weighed on digital assets since his inauguration. Risk-on appetite among investors returned in full force, with Bitcoin (BTCUSD) holding strong above the $100,000 mark while Ether (ETHUSD) logged its best week since 2021. Plus, institutional demand added another layer of support to the rally. Having said that, Bitcoin Treasury company Strategy (MSTR), formerly known as MicroStrategy, has been riding the wave. After grappling with trade-related headwinds earlier this year, the crypto-heavy firm is now reaping the rewards of Bitcoin’s resurgence this month. Investors took note as MSTR shares climbed to a new year-to-date high of $430.35 on May 9, boosted by Bitcoin’s return above six digits. So, with macro tailwinds beginning to shift and Bitcoin back in the spotlight, would it be wise to grab MSTR shares now? About Strategy StockBillionaire Michael Saylor’s Strategy (MSTR) has carved out its identity as the world’s first and largest Bitcoin Treasury company, pioneering a bold strategy that turns digital assets into a core financial engine. By using proceeds from equity, debt, and operational cash flow to amass Bitcoin, the firm offers investors a chance to tap into crypto exposure. With a market cap hovering around $115 billion, Strategy has delivered a standout 44% gain in 2025, easily outpacing the S&P 500 Index ($SPX), which is up just slightly in the year to date. Zooming out, the performance is even more impressive. Over the past year, the stock has skyrocketed a stunning 220%, dwarfing the broader market’s 12% return during the same stretch.

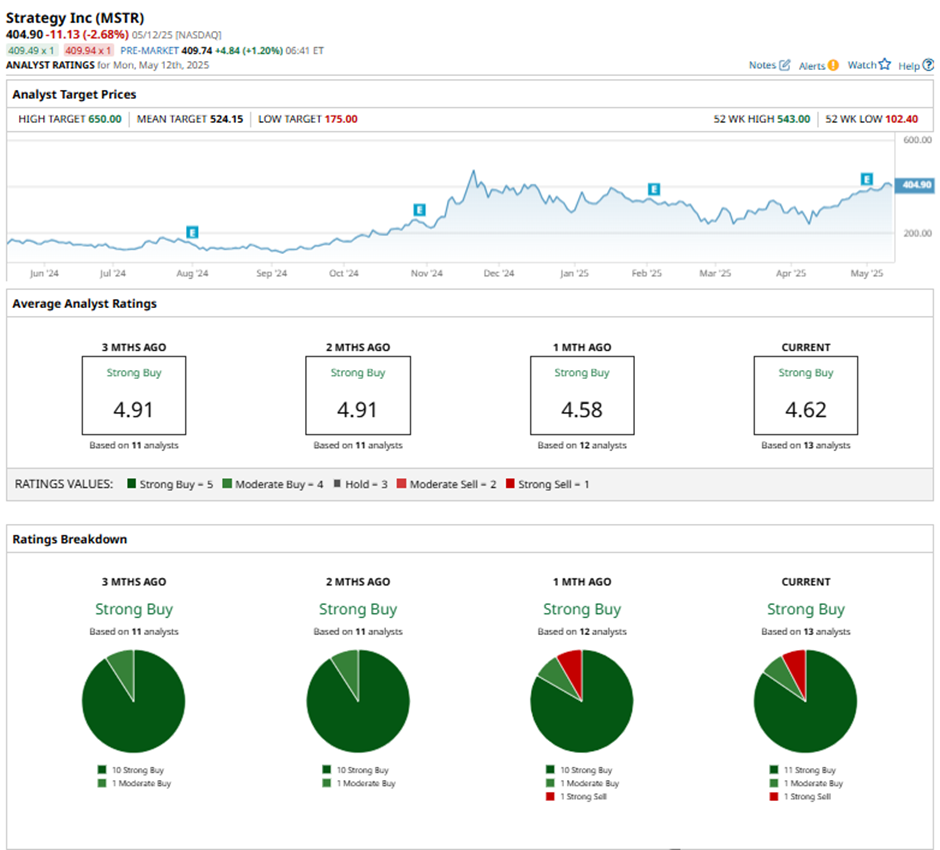

A Closer Look at Strategy’s Q1 PerformanceStrategy’s fiscal 2025 first-quarter earnings, released on May 1, painted a mixed picture of highs and lows. Total revenue slipped 3.6% year-over-year to $111.1 million, coming in below Wall Street’s expectations, while the company’s net loss deepened significantly, widening to $16.49 per share from just $0.31 per share a year ago. Despite these setbacks, a bright spot emerged in the form of explosive growth in the Subscription Services segment, which surged 61.6% year-over-year to $37.1 million, highlighting the company’s growing strength beyond its Bitcoin holdings. On the liquidity front, MicroStrategy ended the quarter with $60.3 million in cash and cash equivalents, up from $38.1 million at the end of 2024. As of the latest reported count, the company’s Bitcoin holdings had ballooned to approximately 568,840 bitcoins, reinforcing its position as the largest corporate Bitcoin holder in the world. While reflecting on the Q1 performance, CFO Andrew Kang highlighted a powerful start to 2025, with Strategy’s Bitcoin yield hitting 13.7% year-to-date (as of April 28), already surpassing 90% of its annual target in just the first four months of 2025. The company has also generated $5.8 billion in Bitcoin gains, meeting 58% of its full-year goal. Riding this momentum, the company is raising the bar, increasing its fiscal 2025 BTC yield target from 15% to 25% and its BTC dollar gain target from $10 billion to $15 billion. What Do Analysts Expect for Strategy Stock?Amid the present Bitcoin rally, Strategy got a fresh vote of confidence from Mizuho Securities last week, as the firm hiked its price target from $515 to $562 and maintained its “Outperform” rating. The upgrade comes on the heels of Strategy’s red-hot start to 2025, with Mizuho pointing to the company’s raised Bitcoin yield and gain targets as key catalysts. The new target also reflects Strategy’s solid Q1 showing, active capital market moves, and relentless Bitcoin buying spree. Overall, Wall Street appears to be largely bullish on MSTR stock, with a consensus “Strong Buy” rating. Of the 13 analysts offering recommendations, 11 are giving it a solid “Strong Buy,” one suggests a “Moderate Buy,” and the remaining one advocates a “Strong Sell.” The average analyst price target of $524.15 indicates impressive 26% potential upside from the current price levels. The Street-high price target of $650 suggests that MSTR could rally as much as 56% from here.

On the date of publication, Anushka Mukherji did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here. |

|

|