|

|

|

Mulvane Cooperative

Cash Bids

Market Data

News

Ag Commentary

Weather

Resources

|

The Next Opendoor? Why Wolfspeed (WOLF) Could Deliver Explosive Gains

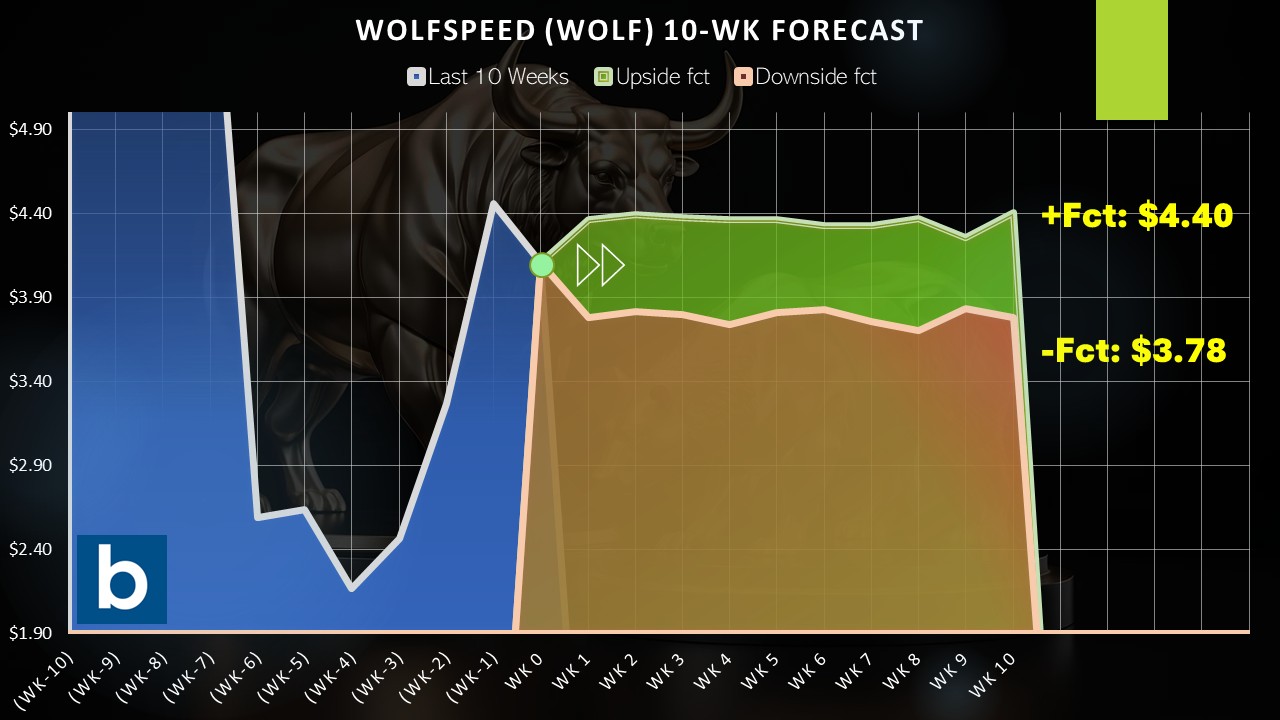

Penny stocks represent high-risk ventures that could easily collapse due to strained finances and significant business challenges. More often than not, they fail, which is why most people should avoid this space. On the other hand, few places in the open market can deliver the robust gains that can sometimes materialize in this arena. Figuring out which names will do so is the hard part. For those that don’t mind taking extreme risks, Wolfspeed (WOLF) should be on your radar. A silicon carbide technology and production company, Wolfspeed provides solutions for energy consumption. It’s most often associated with power-switching and radio frequency (RF) devices for electric vehicles, fast charging systems and renewable energy solutions. It also commands aerospace and defense relevancies. On paper, it should rank as one of the top entities for the modernization of the global economy. Unfortunately, the company suffers from a host of financial problems and headwinds impacting the overall business. Historically, WOLF stock has promised much but has delivered very little. Since the start of this year, the security lost more than 38% of value. In the past 52 weeks, it’s down a staggering 83%. Still, recent price action is providing hope that, at the very least, WOLF stock can arrest the decline. In the past five sessions, shares have gained over 11%. And in the trailing month, the market value has almost doubled. Granted, we’re dealing with the favorable distortions that can arise from the law of small numbers. At the same time, this enthusiasm couldn’t come soon enough. After today’s market close, Wolfspeed will disclose its fiscal third-quarter earnings report. While it’s anybody’s guess what the actual results will reveal, historical trends suggest that investors should keep close tabs on WOLF stock. Essentially, the deck has gotten hot. A Short Squeeze and Probabilities May Combine Delectably for WOLF StockAmong the most potent catalysts working in Wolfspeed’s favor is the extremely high short interest. Right now, the metric stands at 41.04% of its float, which is staggering. About the only mitigating factor here for the bears is that the short interest ratio is only 1.72 days to cover. In theory, then, the bears could unwind their short exposure within two trading sessions. Still, with a 41% short interest, a better-than-expected earnings report and/or positive framing by management can lead to an explosive rally in WOLF stock. This short squeeze, where bears panic out of their position — and thus buy to close, driving up the price — could easily lead to a double-digit gain in one day, much like what happened to Opendoor Technologies (OPEN) recently. On Wednesday, its shares closed at 87 cents, gaining over 24%. You may recall that in late April, I stated that OPEN stock flashed a rare contrarian signal. At the time, the equity was in freefall so very few people in the financial publication space supported a bullish position. However, I didn’t pay attention to the fundamental and technical noise of Opendoor but instead zeroed in on its demand profile. Similarly, I’m not looking at Wolfspeed from the lens of fundamental and technical analysis. Rather, its demand profile, when viewed as discrete behavioral states, suggests that WOLF stock is more prone to be on the receiving end of an upward trajectory. Specifically, WOLF is currently riding a “7-3” sequence: seven weeks of upside mixed with three weeks of downside, with a net negative trajectory across the period. For whatever reason, this pattern yields a 58.33% probability that the following week’s price action will result in upside. Over the next 10 weeks, should the bulls maintain control, the target may range from $4.40 to $5. If the bears dominate, fading into the upper $3 territory represents the main risk.

Overall, what makes the elevated probabilities significant is, as a baseline, the odds that any given one-week long position will be profitable are 48.94%. Therefore, the appearance of the 7-3 sequence adds almost 10 percentage points of favorable odds to the better. As stated earlier, the deck got hot, which incentivizes speculation. Probabilities, Not CertaintiesWhile Wolfspeed is an intriguing idea, prospective speculators shouldn’t be confused. No matter how you cut it, WOLF stock is a high-risk, high-reward name. Until the business starts demonstrating fundamental strength, the suits on the Street will look down on it. Further, by looking at the statistical landscape of WOLF stock rather than the technical or fundamental, I believe that traders may have an edge. But this edge offers no guarantees. The numbers are the numbers and I do see a higher probability of success relative to WOLF’s other behavioral states. Nevertheless, this remains a treacherous game. Ultimately, though, if you were curious about which penny stock can next replicate Opendoor’s blistering swing, take a look at Wolfspeed. The answer could be coming up in just a few hours. On the date of publication, Josh Enomoto did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here. |

|

|